May 7, 2023 –

We all know the peace of mind a solid financial plan provides. And we’ve all heard about the need to carry friendships and hobbies into retirement while keeping active. People should start focusing on relationships and developing a sense of purpose that transcends work in midlife since delaying those tasks can make the transition into retirement difficult. Here are strategies for building a balanced portfolio of interests and relationships:

Investing in Friendships

Since 1938, the Harvard Study of Adult Development has followed hundreds of Harvard University graduates and inner-city Boston residents and their descendants to understand predictors of longevity and health and happiness in later life. One predictor was the quality of their relationships.

Friendships Take Effort

- On average, it takes 200 hours over four months to build a close friendship and up to 60 hours to establish a casual friendship*

- People tend to exaggerate the risks of reaching out to old friends, expecting awkwardness and rejection, but they underestimate the pleasures.**

- Americans age 55 to 64 “are far less socially engaged” with their communities than was the case for people of the same ages two decades ago.***

Take the Time to Invest in Friendships

- Set aside time to invest in the most important relationship to you and try to have more than three close ties.***

- When reaching out to friends, don’t try to be perfect. It’s not what you say but whether you are there for people and are engaged.**

- Try to build routines into your friendships and schedule monthly phone calls with a good friend. Joke around, catch up on life, and have a meaningful conversation.*

Visualizing Your Days In Retirement

Many of us imagine that in retirement, we will travel or pursue the interests we didn’t have time for during our careers. It pays to lay the groundwork for such activities years before retirement.

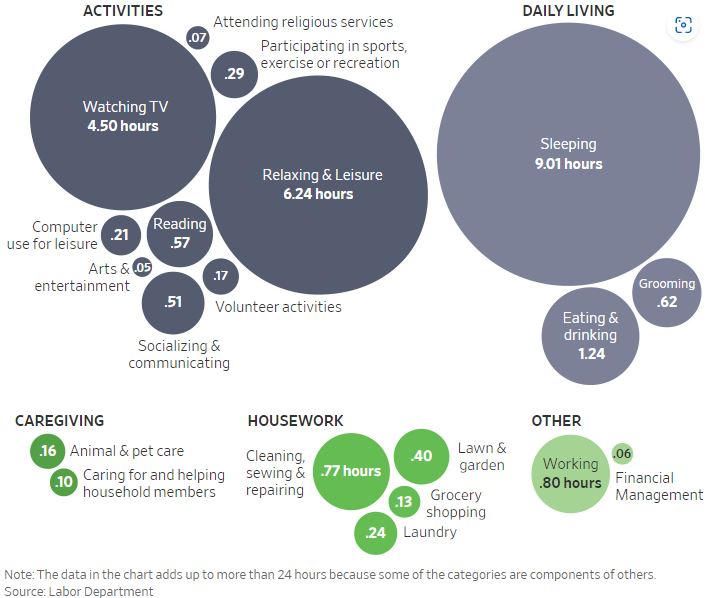

On average, Americans 65 and older spent more time watching television in 2021 than a decade ago. According to the U.S. Bureau of Labor Statistics American Time Use Survey, older adults also spent less time socializing, volunteering, and attending religious services in 2021 than they did a decade ago.

24 hours of retirement – How retirees spend their days

Hobbies, Passions, and Pursuits

Careers can be all-consuming, especially in the peak earnings years that often coincide with midlife. This makes it important to experiment when laying the groundwork for what comes next. Start by asking yourself three lifestyle questions and create a list of answers because written goals are more achievable.

- What were your interests earlier in life, and is it time to revisit them? For example, did you run track in school? Start running again, join a local running club, or volunteer to coach/ keep time with a local team.

- Do you have a bucket list of the things you want to make sure you do in your life? For example, refine “traveling and taking classes” to “visit National Parks and study French.”

- What are you passionate about that would bring greater meaning to your life? For example, do you want to help children read? Try volunteering with Reading Partners.

Disclosures

* Jeffrey Hall, a professor at the University of Kansas and author of a 2019 study that tracked the social lives of almost 500 people after starting college or relocating.

** Research by Nicholas Epley, director of the Center for Decision Research at the University of Chicago Booth School of Business.

*** Laura Carstensen, director of Stanford University’s Center on Longevity.

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. Please consult with your Advisor prior to making any Investment decisions. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.